Customer segmentation is key to growing revenue in SaaS. It’s about dividing your customers into groups based on shared traits or behaviors to improve their experience, reduce churn, and increase lifetime value. Unlike broader market segmentation, SaaS focuses on recurring revenue metrics like Monthly Recurring Revenue (MRR), churn rate, and Average Revenue Per User (ARPU).

Key takeaways:

- Why it matters: Segmentation improves personalization, boosts retention, and drives revenue. For example, Mailchimp’s segmented campaigns had 100.95% more clicks than generic ones.

- Types of segmentation:

- Firmographic: Groups by company size, industry, or revenue.

- Behavioral: Tracks feature usage, logins, and patterns.

- Demographic/Technographic: Focuses on roles, seniority, and tech preferences.

- Strategies: Use data to identify high-value customers, target churn risks, and tailor offers for SMBs or power users. Machine learning can enhance segmentation by analyzing behavior in real time.

- Results: Companies that refine segmentation can cut churn by up to 25% and achieve 10–20% higher conversion rates.

The article also discusses tools, metrics, and how to improve segmentation over time. Focusing on the right segments drives higher-quality revenue and better customer satisfaction.

Customer Segmentation: How Successful SaaS Teams Unlock Scale

Main Types of Customer Segmentation for SaaS

Understanding customer differences can uncover revenue opportunities you might not have noticed before. Let’s look at a few methods that help SaaS companies grow their bottom line.

Firmographic Segmentation

Firmographic segmentation groups B2B customers based on company characteristics like size, industry, revenue, location, and organizational structure. This approach helps you figure out which businesses to prioritize and can guide tiered pricing strategies.

For example, in early 2021, Baremetrics analyzed churn rates among Canadian customers and noticed a troubling trend: users who purchased a three-month plan were canceling at the three-month mark. To address this, they replaced the plan with a six-month minimum. This change reduced churn and kept revenue steady, while also cutting down on sign-up and cancellation costs.

"Most SaaS executives think that what you charge will determine your success. In fact, who and how you charge determines your success. Segmentation is the first step to SaaS pricing success."

– Dan Balcauski, Founder and Chief Pricing Officer, ProductWise

Next, let’s see how analyzing behavior can provide even deeper insights.

Behavioral Segmentation

Behavioral segmentation focuses on what customers actually do – tracking data like feature adoption, login frequency, usage patterns, and purchasing habits. It’s less about what customers say they need and more about their real actions.

Take Kommunicate as an example. In 2025, they discovered that only 28% of users were adopting key features. By introducing in-app prompts and a checklist to guide chatbot integration, they saw a jump in sign-up completion rates from 45% to 60%. Feature adoption also rose to 41% within just seven months.

Similarly, Baremetrics found that Stripe users were upgrading 50% more often than users on other payment platforms. This insight allowed them to focus their marketing efforts where they could make the biggest impact.

"Behavioral segmentation is your detective hat, revealing what users do rather than what they say. It helps you spot those golden moments of value and fix friction points before they become deal-breakers."

– The Statsig Team

To combat churn, you can create segments of users who haven’t logged in for 30 days and send automated re-engagement emails. For high-value accounts at risk of canceling, personal outreach from senior support managers might be more effective. Automated approaches, on the other hand, can work well for lower-value accounts.

Behavioral data is powerful, but pairing it with demographic and technographic insights can make your segmentation even sharper.

Demographic and Technographic Segmentation

Demographic and technographic segmentation adds another layer to your understanding of customers, helping you craft more targeted strategies.

In SaaS, demographic segmentation often focuses on job roles, titles, and seniority levels. For instance, a CMO and a CEO might both be decision-makers, but their challenges and priorities are usually very different. Tailoring your messaging to these differences can lead to better conversion rates.

Technographic segmentation, on the other hand, looks at the technology your customers use – things like operating systems, browsers, or software integrations. This kind of data can highlight areas where your product might need improvement. For example, if a group of users is exporting data manually to another tool, it might signal the need for a native integration. Fixing these gaps could reduce friction and make your product more appealing.

By combining these approaches, you can pinpoint high-value segments. Imagine identifying "mid-sized marketing agencies using HubSpot who haven’t activated your reporting feature." That’s a highly specific group you can target with onboarding campaigns or feature tutorials.

And don’t forget the 80/20 rule: about 80% of your revenue often comes from just 20% of your customers. Segmentation helps you zero in on that 20%, making it easier to serve them effectively while optimizing resources for the rest of your customer base.

How to Build a Customer Segmentation Strategy

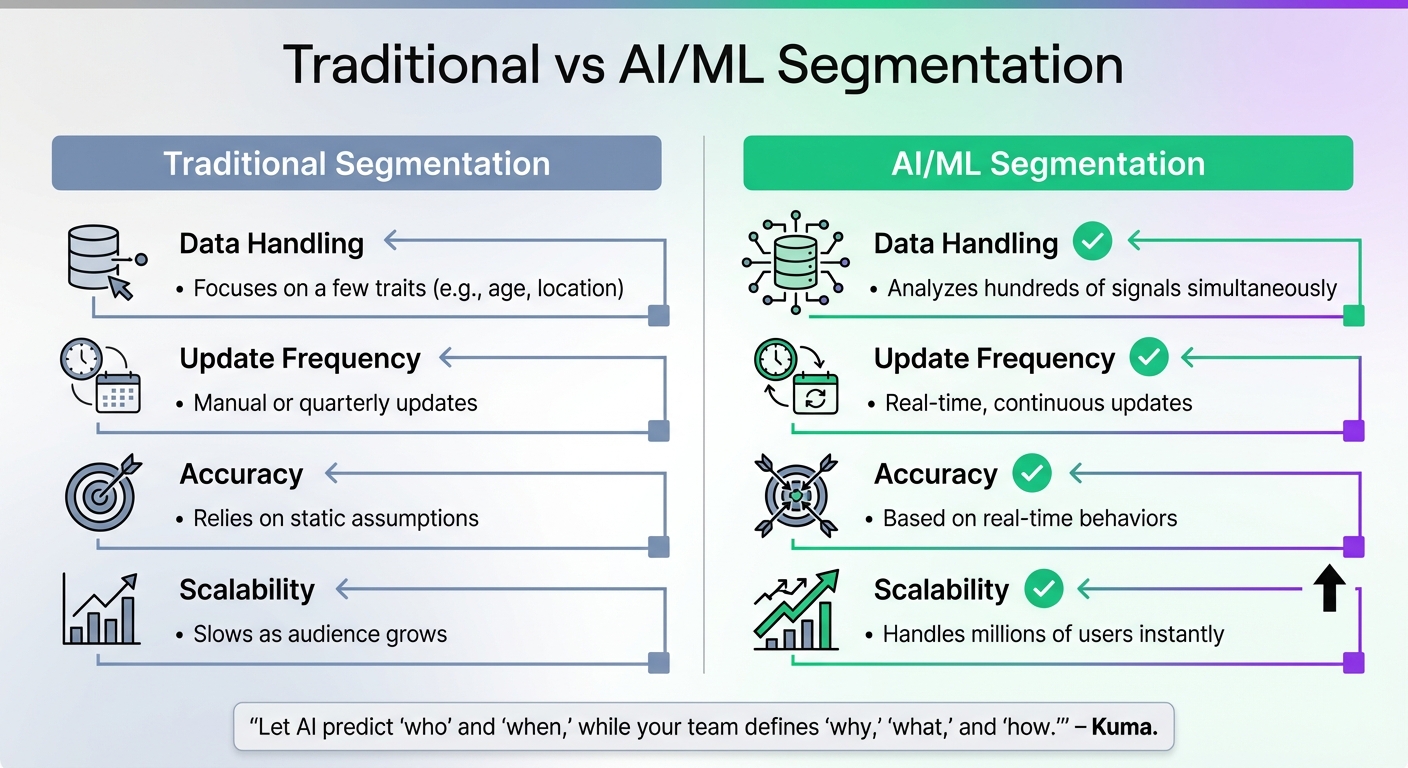

Traditional vs AI-Powered Customer Segmentation Methods Comparison

Now that you’ve seen the different types of segmentation, let’s dive into creating a strategy that can help boost revenue.

Analyzing Customer Data

To start, calculate a quality score by subtracting maintenance and acquisition costs from the Annual Contract Value (ACV). Adjust this score to account for revenue growth or cancellations.

Before diving into data analysis, it’s helpful to form hypotheses about what makes a customer “high quality.” For example, you might guess that companies with smaller IT teams tend to be better clients. These assumptions keep your research targeted and prevent you from getting lost in a sea of data.

When analyzing your data, combine firmographic, technographic, and behavioral information. This multi-dimensional approach can reveal patterns that single-focus analysis might miss.

Make sure to clean your data. Remove test accounts, outliers, and new customers to avoid skewing results. Instead of relying solely on averages, segment your metrics. As Clair Pacey from Baremetrics points out:

"By only looking at averages, you might be missing something big, like a secret cash cow or massive budget waster".

Set measurable goals using the SMART framework. For instance, you could aim to increase feature adoption by 20% in a specific segment or reduce churn by 25% in a certain region.

Tools and Methods for Data Collection

Once your analysis framework is ready, focus on collecting high-quality data. Effective segmentation depends on integrating data from multiple sources. Sync your CRM systems (like HubSpot or Marketo) with product analytics tools (such as Mixpanel or Amplitude) and customer success platforms. This integration provides a real-time view of customer behavior and automates data updates.

During onboarding, use welcome screens to collect firmographic and needs-based data. Keep it simple – ask for just a few key details to avoid frustrating new users. You can gather more information later through follow-ups and usage tracking.

For deeper insights, interview team members from Sales, Customer Success, and Marketing. Their input can help identify strategies that work and uncover unmet customer needs.

Don’t just talk to satisfied customers. Interview churned customers and prospects who chose competitors to pinpoint barriers and missed opportunities. When conducting surveys, replace standard 1–5 rating scales with forced-ranking methods like MaxDiff. This approach avoids the common issue of every feature being rated as “important”.

To ensure your analysis is statistically reliable, aim for 10 to 100 survey responses per variable tested. For example, if you’re evaluating 25 customer “jobs to be done,” you’ll need between 250 and 2,500 responses.

With these methods in place, you’ll be ready to explore advanced segmentation techniques powered by machine learning.

Using Machine Learning for Segmentation

Machine learning (ML) can take your segmentation to the next level by identifying patterns across hundreds of behavioral signals at once. Clustering models, for example, group customers based on shared behaviors like browsing habits, campaign engagement, and product usage. This helps uncover high-value segments that demographic data alone might overlook.

Start with interpretable models that highlight feature importance and provide transparent scoring. These models help your team understand why customers are grouped together, building trust in the system. Once you’re comfortable, add predictive scoring to rank customers by their likelihood to upgrade, churn, or take specific actions.

Unlike traditional methods, ML-driven segmentation updates in real time. This allows you to act on immediate opportunities, such as recovering abandoned carts or addressing drops in usage.

| Feature | Traditional Segmentation | AI/ML Segmentation |

|---|---|---|

| Data Handling | Focuses on a few traits (e.g., age, location) | Analyzes hundreds of signals simultaneously |

| Update Frequency | Manual or quarterly updates | Real-time, continuous updates |

| Accuracy | Relies on static assumptions | Based on real-time behaviors |

| Scalability | Slows as audience grows | Handles millions of users instantly |

Keep your segments manageable – four to eight high-signal groups are typically more actionable for creative teams and budget planning. Retrain your models on a schedule that aligns with your business cycle, such as weekly or monthly, while running daily scoring for execution.

"Let AI predict ‘who’ and ‘when,’ while your team defines ‘why,’ ‘what,’ and ‘how.’"

– Kuma

Finally, ensure your ML-driven segments integrate directly with your orchestration tools. This allows them to serve as triggers or decision points in automated customer journeys. The result? A self-optimizing system where predictions drive actions, and performance data feeds back to refine future scores – all without manual effort.

sbb-itb-ad881f4

Revenue Growth Strategies by Customer Segment

Once your segmentation system is in place, the next step is to use it effectively. Different customer groups require tailored strategies to maximize revenue. Here’s how to align your approach with each segment.

Upselling and Retention for High-Value Customers

High-value customers are your revenue drivers and brand ambassadors. Start by ranking them with a quality score. This involves calculating their Annual Contract Value (ACV), subtracting acquisition and maintenance costs, and adding bonuses for factors like revenue growth or marquee status.

These accounts deserve personalized attention. Offer specialized support, professional services, and dedicated account management. Use behavioral data to spot opportunities – like when they activate advanced features or show increased usage – and introduce targeted upsells for complementary products.

71% of customers expect personalized interactions, and 76% feel frustrated when those expectations aren’t met. Shift your focus from acquiring new leads to boosting Net Revenue Retention (NRR) by nurturing and expanding existing high-value relationships.

"Sales into the wrong segment can be more expensive to sell and maintain, and may have a higher churn rate or lower upsell potential." – Tien-Anh Nguyen, OpenView Partners

Once you’ve secured these top-tier accounts, turn your attention to identifying and addressing churn risks in other segments.

Reducing Churn in At-Risk Segments

Churn often begins with subtle warning signs, such as decreased product usage, fewer logins, increased support tickets, or account downgrades. Improving customer retention by just 5% can increase profits by 25% to 95%.

Create a customer health score that combines metrics like activity levels, NPS feedback, and support interactions. If the score drops below a certain threshold, trigger proactive alerts. For high-value accounts, consider direct outreach. For smaller customers, automated email sequences can help.

Involuntary churn – caused by issues like expired credit cards or billing errors – also deserves attention. Automated dunning systems with retry logic and reminders can recover lost revenue without requiring manual intervention. Use churn data to refine your subscription models, reducing cancellations and stabilizing revenue.

From here, focus on tailoring pricing and features to meet the specific needs of SMBs and power users.

Tailoring Offers for SMBs and Power Users

Building on retention and upsell efforts, adapt your pricing and product offerings to suit the unique needs of different user groups.

For SMBs, usage-based pricing works well, as it aligns costs with the value they receive. Tiered pricing with flexible feature sets allows smaller businesses to start small and scale as they grow.

Power users, however, thrive on advanced features and personalized experiences. Behavioral triggers and in-app messages can encourage them to adopt advanced features, boosting adoption rates by 20-30%. Since 80% of a SaaS company’s revenue typically comes from the top 20% of users, this group should be a priority.

SMBs often prefer self-service options to reduce friction and minimize churn. On the other hand, power users may require more hands-on support and guidance. Upsell campaigns targeted to their behavior can achieve conversion rates between 10-25%.

| Segment | Best Pricing Model | Key Strategy |

|---|---|---|

| SMBs | Usage-based or entry-tier pricing | Self-service options, low barrier to entry |

| Power Users | Advanced tiers with premium features | Behavioral triggers, personalized upsells |

| High-Value Accounts | Custom enterprise pricing | Dedicated support, account management |

Measuring and Improving Segmentation Over Time

Segmentation isn’t a one-and-done task – it’s an ongoing effort. Markets shift, customer needs evolve, and staying ahead means regularly revisiting your approach. To keep up, focus on tracking key performance metrics that reveal what’s working and what needs adjusting.

Key Performance Indicators (KPIs) for Segmentation

To refine your segmentation strategy, you need to measure the right things. Start with revenue metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) for each segment. These numbers highlight which groups are driving the most income.

Retention is another critical area. Net Revenue Retention (NRR) shows whether current customers are spending more over time. For SaaS businesses, the goal varies: enterprise-focused companies should aim for 125%, while those serving SMBs should target 90%.

Efficiency metrics like Customer Acquisition Cost (CAC) and the LTV:CAC ratio reveal whether you’re investing in the right audiences. Engagement can be tracked through the DAU/MAU ratio, which measures how "sticky" your product is for each segment. To gauge satisfaction, turn to the Net Promoter Score (NPS), which reflects customer loyalty and the likelihood of referrals.

| KPI Category | Specific Metric | Purpose |

|---|---|---|

| Growth | MRR/ARR per Segment | Identifies high-revenue customer groups |

| Retention | Net Revenue Retention | Tracks revenue growth from existing customers |

| Efficiency | LTV:CAC Ratio | Measures the ROI on acquiring specific segments |

| Engagement | DAU/MAU Ratio | Tracks product usage and daily value |

| Satisfaction | Net Promoter Score (NPS) | Measures loyalty and referral potential |

"Having great telemetry is a necessary condition for being a great growth team. You can’t be great at growth without rock-solid data infrastructure."

- Morgan Brown, VP, Growth, Shopify

Interestingly, even a small 1% improvement in segmentation can lead to a 1.6% boost in overall revenue. Companies that consistently review and refine their segmentation strategies tend to outperform competitors by 25% in revenue growth.

Monitoring and Adjusting Your Approach

As customer behaviors and market conditions shift, your segmentation strategy must evolve too. Take Baremetrics as an example. In August 2021, they noticed a spike in customer churn at the 3-month mark. After analyzing this segment, they discovered it mostly consisted of startups looking for short-term insights. Their solution? They eliminated the 3-month subscription option and introduced a 6-month minimum. This change stabilized revenue while cutting costs tied to frequent cancellations.

| Review Frequency | Focus Area | Key Metrics to Monitor |

|---|---|---|

| Monthly | Revenue Trends | MRR, New Sign-ups, Expansion MRR |

| Quarterly | Profitability Deep-Dive | CAC, LTV, CAC:LTV Ratio, Segment Margins |

| Annually | Strategic Reassessment | Segment Validity, Market Shifts, ICP |

Regular reviews should involve your sales, marketing, and customer success teams. These teams interact with customers daily and can provide insights that raw data might miss. To dig deeper, use surveys, focus groups, and interviews to uncover the "why" behind segment behaviors. With 82% of consumers willing to share basic info for personalized experiences, this feedback can be a goldmine.

Keep your segmentation manageable by limiting it to 3–4 broad tiers (like Enterprise, Mid-Market, and SMB). Only dive into more detailed segmentation if the data strongly supports it.

How Graystone Consulting Can Help

Adapting your segmentation strategy to evolving markets often requires expert guidance. That’s where Graystone Consulting comes in. They specialize in building data-driven marketing systems that integrate CRM tools, analytics, and customer data.

Their Diagnostic Sprint starts with a full-funnel audit to identify where your segmentation might be losing revenue. You’ll get a detailed KPI baseline, a revenue leak analysis, and a customized growth strategy. From there, their Growth System Installation sets up the infrastructure you need – everything from CRM automations to real-time KPI dashboards.

For ongoing support, their Leadership Retainer offers fractional CMO services. This includes regular strategy sessions to ensure your segmentation aligns with business goals and adapts to changes. Learn more at Graystone Consulting.

Conclusion

Customer segmentation has become a critical driver of growth across all departments. It enables businesses to achieve better growth and retention outcomes by leveraging advanced, data-driven strategies.

The days of casting a wide net and treating every customer the same are fading. Instead, successful SaaS companies are adopting targeted approaches that focus on high-value segments. As Patrick Campbell, Founder of ProfitWell, aptly notes:

"The most common mistake we see SaaS companies make is treating all prospective customers as equally valuable. This leads to diluted messaging and inflated CAC".

By zeroing in on customer segments where the LTV:CAC ratio exceeds 3:1, top-performing companies generate higher-quality revenue. This approach not only reduces churn but also opens doors to stronger expansion opportunities.

Segmentation doesn’t just refine marketing – it influences everything from product development to sales and customer success strategies. It replaces intuition with data-backed decisions. Josh Allen, CRO at Drift, shares his experience:

"Segmentation transformed not just our messaging, but our entire organization structure and product roadmap. It’s the foundation that enabled our rapid growth".

This shift in strategy lays the groundwork for actionable implementation.

If you’re ready to build a segmentation strategy that delivers measurable results, Graystone Consulting can help. Their Diagnostic Sprint uncovers revenue leaks, integrates connected marketing systems, and provides fractional CMO support to ensure your segmentation evolves with market demands. Learn more at Graystone Consulting.

FAQs

How does machine learning improve customer segmentation for SaaS businesses?

Machine learning takes customer segmentation for SaaS to a whole new level by delivering real-time, predictive insights that traditional methods just can’t match. It processes massive amounts of customer data quickly, uncovering patterns and behaviors that would otherwise go unnoticed. The result? More precise and flexible customer segments that pave the way for highly tailored and relevant marketing strategies.

What’s more, machine learning doesn’t just stop at analyzing current data – it can also predict future customer actions. For example, it can flag customers at risk of churning or highlight those with high potential value, giving businesses the chance to act before it’s too late. And because these customer segments are continuously updated with real-time data, SaaS companies can keep their messaging sharp and in tune with what their customers actually need, leading to stronger engagement and, ultimately, more revenue.

What metrics should SaaS companies track to improve customer segmentation?

To refine customer segmentation, SaaS companies should pay close attention to a few key metrics that can provide valuable insights:

- Revenue per segment: This metric reveals which customer groups bring in the most revenue, helping identify areas with the greatest growth potential.

- Customer lifetime value (CLV): By calculating the total revenue a customer is likely to generate throughout their relationship with the business, companies can focus on retaining high-value customers and fine-tune strategies to minimize churn.

- Behavioral and demographic data: Analyzing factors like product usage trends, acquisition channels, and lifecycle stages sheds light on how different segments interact with the service, paving the way for more precise marketing and engagement efforts.

Using these data points, SaaS businesses can create more personalized and effective segmentation strategies, ultimately boosting growth and keeping customers engaged.

How can behavioral segmentation help SaaS companies reduce customer churn?

Behavioral segmentation is a game-changer for SaaS companies looking to keep their customers engaged and reduce churn. By grouping users based on their interactions with the product – like how often they log in, which features they use, or their overall engagement levels – businesses can spot patterns tied to customer retention. For instance, if a user’s activity starts to decline, the company can step in with personalized support or special offers to bring them back on board.

What makes this approach even more powerful is dynamic segmentation. This method updates automatically as customer behaviors shift, giving teams the ability to act in real-time. Whether it’s sending a timely email, tweaking features, or offering a tailored solution, this adaptability can significantly boost customer satisfaction and loyalty. With these tools in hand, SaaS companies can build stronger connections, keep churn in check, and set the stage for steady growth.

0 Comments